What was needed?

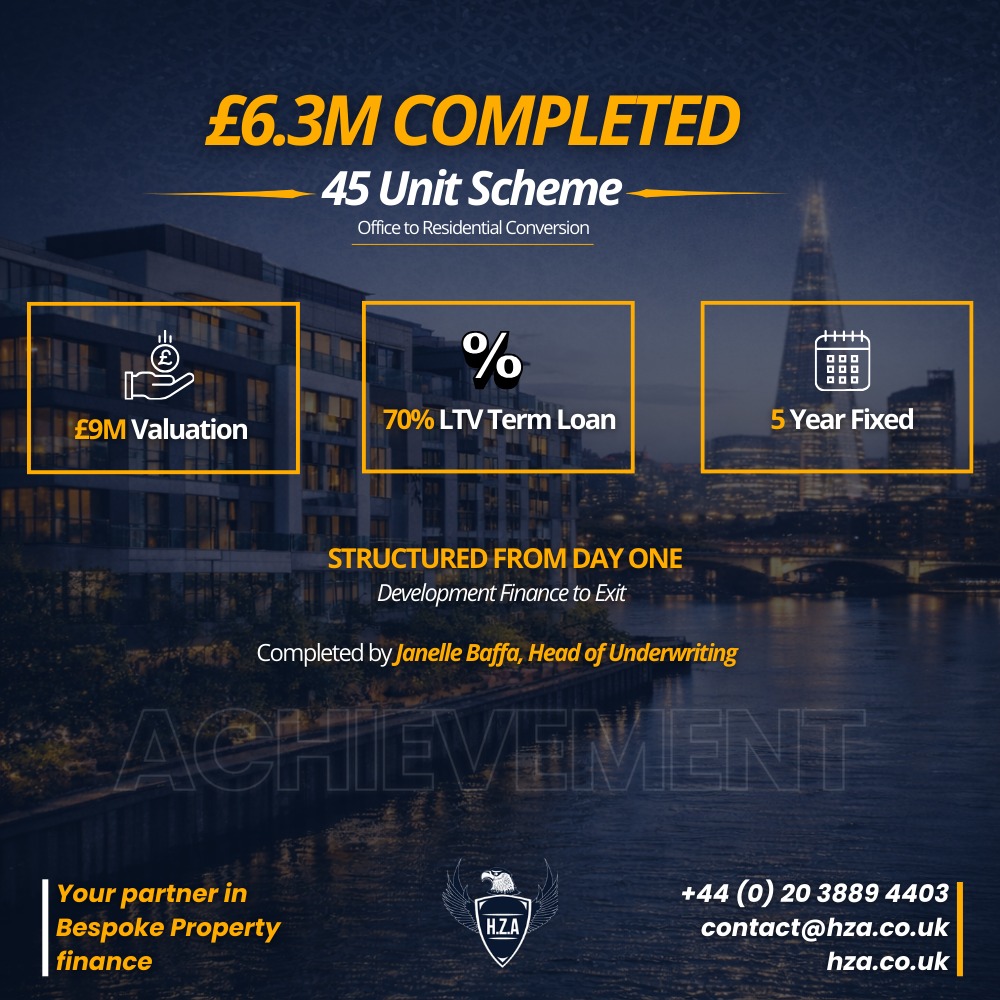

Our client needed a longer term finance arrangement for some unsold properties on a development they had completed, and their previous finance arrangement had come to an end.

Having completed the development but been unable to sell the remaining units before their previous finance completed, our client needed to re-arrange the finance on these units as soon as possible.

What did we do?

We sat down and spoke our client about their options, such as development exit finance. Eventually, the client decided to hold on to the asset and collect a rental income from the left over units, so we arranged a BTL, or Buy To Let, mortgage for these units.

The market value of the properties was £2,500,000 and the client required finance for a 75% LTV mortgage. This meant that the total capital they would be releasing into a BTL mortgage was 75% of the market value of the properties.

As it was a mortgage that was agreed, rather than a short term finance option, the rate arranged was at 3.95% per year.

A 5 year fixed rate mortgage was arranged for 75% of the market value of the properties.

As this was a mortgage, the client would look to re-arrange a new fixed rate at the end of the term.

Contact Us Today to achieve Same Results

Would you like to discuss what other options are available to explore ?