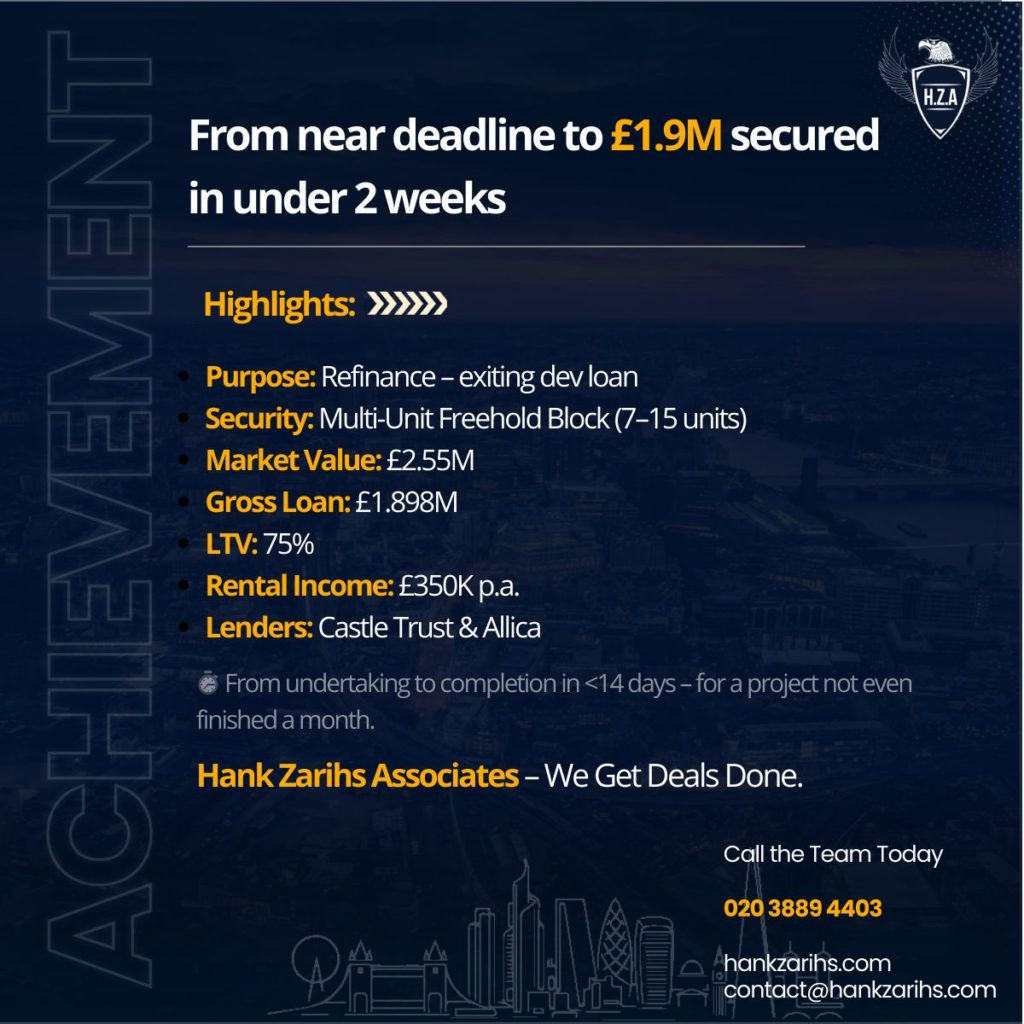

Our client was approaching the end of their development loan term on a project that wasn’t fully finished. We stepped in, negotiated with the existing lender for more time, and took the deal from undertaking to completion in less than 14 days.

Deal Highlights:

Purpose: Refinance – exiting an existing development loan

Security: Medium Multi-Unit Freehold Block

Market Value: £2,550,000

Gross Loan Achieved: £1,898,240

LTV: 75%

Lenders: Castle Trust Bank & Allica Bank

Head of underwriting: Janelle Baffa

At Hank Zarihs Associates, speed and precision are what we do best, helping developers and investors protect their projects and secure the funding they need, when they need it.

Big thanks to the team and partners who pulled together to get this done.

Contact Us Today to achieve Same Results

Would you like to discuss what other options are available to explore ?